A Separately Managed Account (SMA) is an individual portfolio of investments administered by a professional money manager on behalf of a client. The individual investor retains complete control over the assets and can direct the money manager to modify their portfolio as needed. You can customize it according to specific investment goals and preferences. You may choose between hundreds of stocks, bonds, and other securities to create a unique portfolio tailored to your financial objectives. SMAs differ from other investments, such as mutual funds and exchange-traded funds (ETFs), in which your funds are held together in one pool with other investors' funds. Institutional or affluent retail investors typically use SMA. These investors usually have at least six figures to invest and seek to collaborate with a professional money manager to focus on a single, personalized investing goal. In an SMA, you hire a professional money manager to invest your funds according to your objectives and risk tolerance. You give the money manager the discretion to invest in stocks, bonds, mutual funds, ETFs, or other securities on your behalf. Suppose you have $200,000 to invest. You give $100,000 to a professional money manager who creates an SMA for you. After considering your financial goals and risk tolerance, the money manager assembles a portfolio of stocks, bonds, and certificates of deposit (CDs). With the SMA, you can monitor the performance of specific assets within your portfolio and modify them. Say a particular stock you own underperforms; you can tell your money manager to sell it and invest in additional CDs instead. On the other hand, you invest the other $100,000 in mutual fund shares. Your money is pooled with thousands of other investor's funds and managed by a portfolio manager. The managers determine the strategy and share dividends with you according to the fund's performance. With the mutual fund, you do not own a specific stock or bond, only shares of the fund. You do not control how the fund managers invest the funds. You also cannot monitor how each investment performs. The advantages of SMAs include customization, direct ownership of shares, transparency, and reduced capital gains tax. Depending on your risk tolerance, long-term financial goals, and personal values, you can customize the mix of stocks, bonds, and other securities in your SMA portfolio. For example, environmentalists may exclude mining or oil company stocks in their portfolios. Unlike a mutual fund, where the individual investor owns shares of the fund, an SMA account gives you direct ownership of the underlying investments. When stock prices go up or down, your returns will reflect those changes. Due to the direct ownership of shares, SMAs are highly transparent. It lets you know precisely where your SMA is invested and how those investments perform. It also allows you to make more informed decisions about changes or additions to your portfolio.What Is a Separately Managed Account (SMA)?

How a Separately Managed Account (SMA) Works

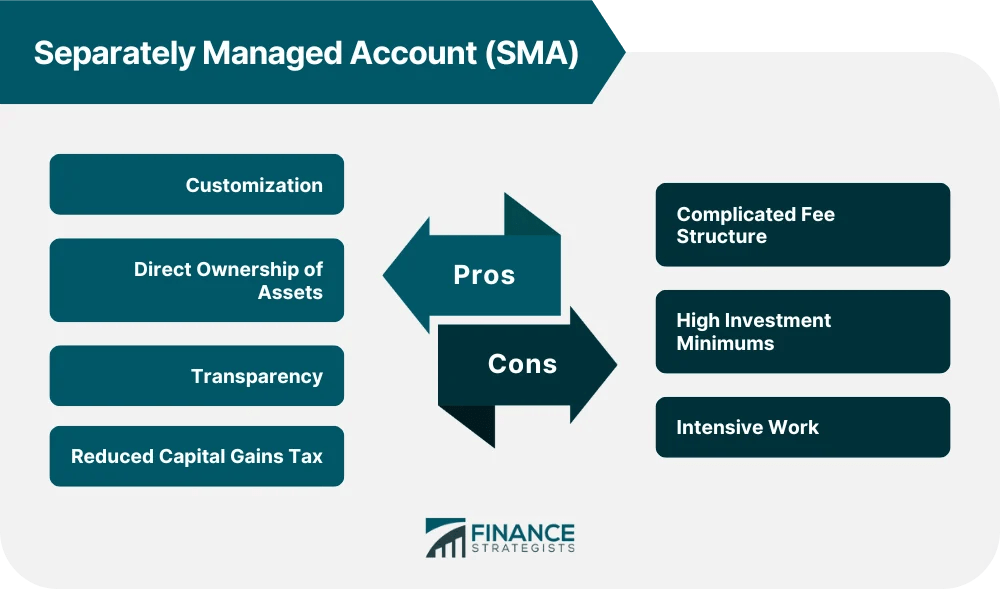

Pros of SMAs

Customization

Direct Ownership of Shares

Transparency

It is especially true compared to pooled investment vehicles, which may only partially disclose their holdings regularly. As such, investors must wait for periodic public filings or annual reports to get an accurate picture of their investments' performance and composition.

Reduced Capital Gains Tax

Depending on the timing of the sale of particular assets, you may lessen capital gains tax liabilities. It is because the taxable event only occurs when an individual asset is sold, and it is not necessary to liquidate the entire portfolio to recognize gains or losses.

For example, your SMA includes Companies A and B stocks, purchased simultaneously and at equal prices. In ten years, A's value doubled while B was halved. If you tell your money manager to sell these shares, losses in B will offset gains in A, removing capital gains taxes.

There is no such control for pooled investment vehicles. Mutual funds typically pay capital gains taxes once a year, shouldered by all investors.

Cons of SMAs

Some disadvantages include complicated fee structure, high investment minimums, and intensive work.

Complicated Fee Structure

Fees may include asset-based fees, transaction costs, custodial fees, and miscellaneous fees. Some of these fees can be difficult to understand. Costs are typically listed in Form ADV Part 2, which is not readily available online.

On the other hand, pooled investment vehicles usually have prospectuses that detail all associated fees and costs.

High Investment Minimums

The added flexibility and customization afforded by SMAs can cause minimum investments to be higher compared to pooled investment vehicles. It typically ranges from $50,000 to $100,000 and beyond.

Because of this high threshold, lower net-worth investors may be unable to access an SMA structure's benefits.

Intensive Work

There is a need to be diligent in research and management. You are responsible for selecting the manager, monitoring performance, and making necessary changes. All these can require significant time and resources.

Also, SMAs are less actively managed than pooled investment vehicles, leaving investors solely responsible for any changes they want to be made to their accounts.

Comparing SMAs to Other Pooled Investment Vehicles

As SMAs have a single owner of the securities in the fund, the owner has more control and transparency over the investment and how it is managed. In comparison, a group of investors owns mutual funds or ETFs.

One of the most important advantages of SMA is tax gain or loss harvesting, which reduces the capital gains tax burden by selectively realizing profits and losses in your separate account portfolio.

Furthermore, other pooled investment vehicles and SMAs are groupings of multiple assets. Specifically, an ETF monitors an index, making its holdings more consistent. Alternatively, SMA holdings are more flexible and fluid, making them more appealing to high-net-worth investors.

Finally, because SMAs are managed separately from other pooled vehicles, fees are typically higher than mutual funds or ETFs but lower than those of a typical hedge fund or private equity fund structure.

It makes them attractive for those who want more customization and flexibility without the high fees that come with a hedge fund or private equity structure.

Factors to Consider in Choosing an SMA Manager

When deciding, check a potential manager's investment performance, philosophy, approach, and process. Ensure they are registered and compliant with regulatory bodies.

Investment Performance

Review their performance records. You should pay close attention to the strategies a manager has used in the past and compare them to other investment vehicles available on the market.

Performance should be evaluated over the long term, not based on short-term results. Consider reviewing historical returns and identifying potential risk factors to determine whether their strategy fits your overall goals and objectives.

Investment Philosophy and Approach

Managers will employ different techniques to achieve their desired outcomes, and it is essential to understand exactly how they generate returns.

For example, do they focus on passive investing or actively managed strategies? Do they value investors or growth investors? Do they emphasize income strategies or capital appreciation strategies?

Investment Process

Find out how the manager researches and selects investments. Do they have an established process for conducting due diligence? How do they decide when to buy, hold, or sell securities?

Quality processes emphasize rigorous research and methodologies, risk management, technology platforms, investment monitoring systems, and portfolio construction techniques tailored to meet your needs.

Compliance with Regulatory Bodies

SMA managers should be registered with the Securities and Exchange Commission (SEC) and comply with the Investment Advisers Act of 1940.

Check the Investment Adviser Public Disclosure (IAPD) website for background and compliance with applicable laws.

They should clearly understand their fiduciary responsibilities, demonstrate transparency in conducting business, and abide by ethical standards.

Final Thoughts

An SMA is an investment strategy that provides individual investors with a portfolio of stocks, bonds, and other securities. Unlike mutual funds or ETFs, investments in an SMA are not pooled together with the assets of other investors.

Instead, each investor owns a customized portfolio administered by a professional money manager. It allows for flexibility, control, transparency, and tax deductions. However, SMAs also tend to have high investment minimums and complicated fees and require more work.

In selecting a professional to handle your SMA, do your due diligence and check investment performance, approach, processes, and regulatory compliance. It is also essential to ask a qualified financial advisor to guide you in decision-making.

Separately Managed Account (SMA) FAQs

A mutual fund is a collective investment scheme that pools various investors' funds and invests in different financial instruments. Unlike mutual funds, SMAs are tailored to the specific needs of individual investors, allowing them to customize their portfolios. SMAs also give investors direct ownership over assets and more control over how their investments are managed.

SMAs offer investors several advantages, including customization, direct ownership of assets, transparency, and lessened capital gains taxes.

SMAs are typically recommended for high-net-worth individuals with extensive portfolios who want more control in managing their investments. SMAs can also benefit investors who want to minimize capital gains taxes or take advantage of tax-loss harvesting strategies.

The minimum investment requirement can range from $50,000 to $100,000 and above.

SMAs include higher minimum investment requirements, complicated fee structures, and intensive work compared to pooled investment vehicles like mutual funds and exchange-traded funds (ETFs).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.